CBP will increase the customs processing fee effective fiscal year 2023.

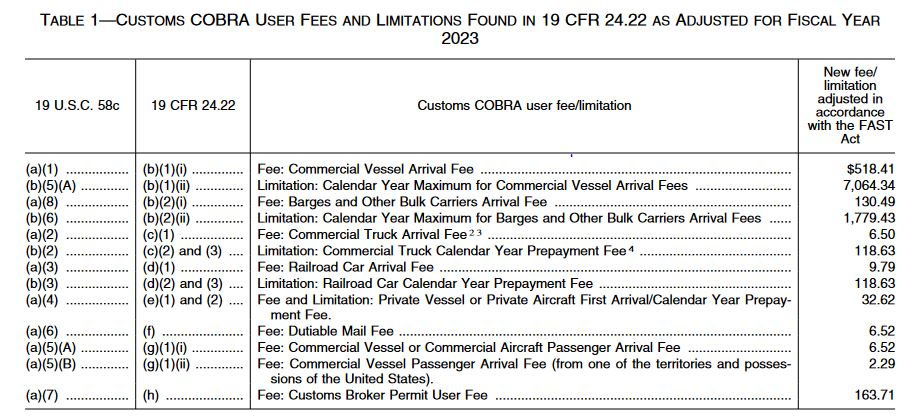

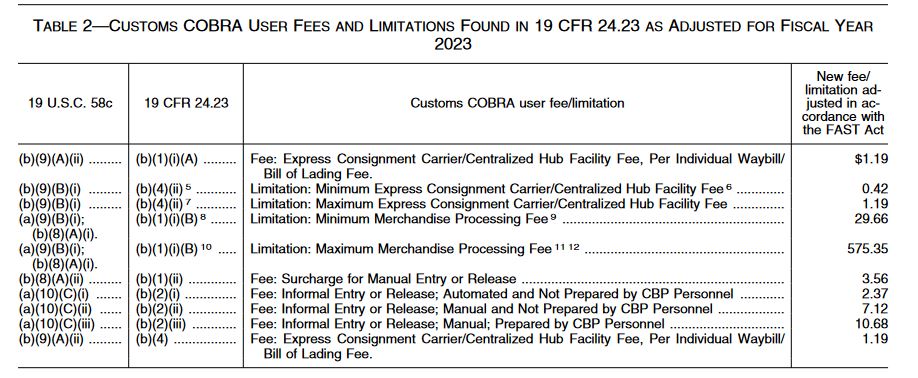

“The Merchandise Processing Fee” customs clearance fee will be 0.3463 percent of the customs value for merchandise shipments valued at more than US$2,500 (so-called “formal entries”). A minimum and a maximum amount apply. CBP will increase these amounts on October 1, 2022. From that date, CBP will always charge a minimum of US$29.66 (previously US$27.75) and a maximum of US$575.35 (previously US$538.40).”

Ad valorem percentage remains at the same level

“The increase in amounts applies to merchandise shipments with a value of less than US$8,563 and greater than US$166,095. For shipments with a value between US$8,563 and over US$166,095, the customs ad valorem fee will remain unchanged at 0.3464 percent beginning in October 2022.

When packages imported in the mail are customs cleared, a fee of US$6.11 per package has previously applied. CBP will also increase this fee to US$6.52 per package beginning October 1, 2022. The Postal Service will collect the fee at the time of delivery.”

Source: Publication by Susanne Scholl | GTAI -Newsletter August 31, 2022